Total Screens:

100+

Project

Under Development

Focused on

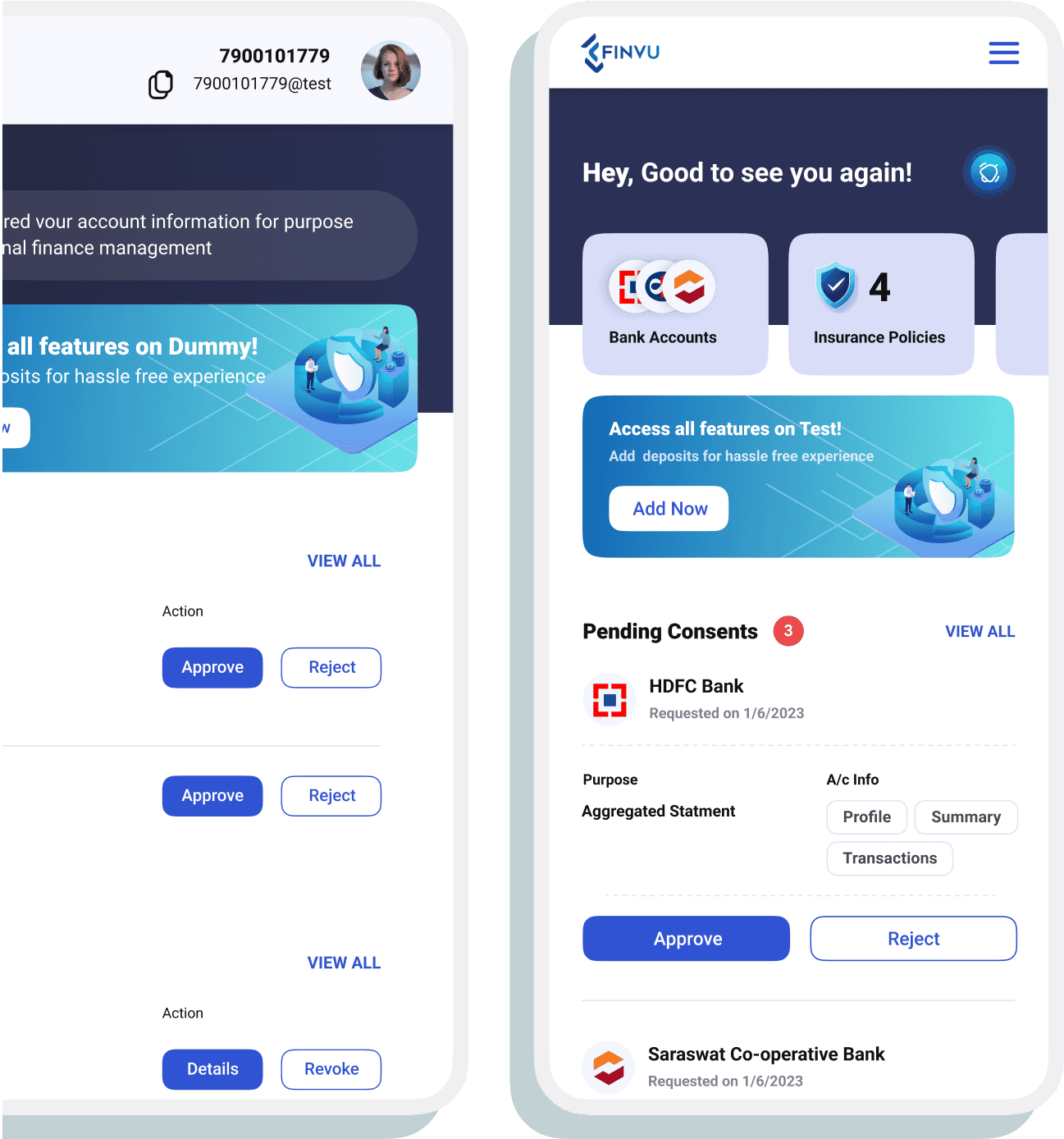

Investment Advisory Application

Role

Team

1 Designer, 2 Product Managers and Development team of 5

Timeline

At the end of our 6-month timeline, we delivered a complete, user-centric product with over 100 screens. The application successfully simplified complex investment journeys into clear, actionable steps, and our rigorous process ensured it met both regulatory requirements and a high standard of user experience. The product is now finalized and poised to go live on the Play Store, a testament to the team's focused effort and the strategic use of our design process

My biggest learning from this project was discovering how to navigate the complex intersection of financial regulations and user psychology. It taught me that building trust is the most critical design principle in FinTech. I also learned to harness the power of AI to supercharge a lean design process, proving that strategic innovation can drastically reduce costs and accelerate delivery.

Moving forward, I'm eager to analyze post-launch user data from the live product, which will inform our next steps and allow us to iterate on the experience with real-world feedback. The goal is to continuously refine Advisor Alpha, ensuring it remains the most trusted and intuitive investment tool on the market.